Year-End Rollover¶

The Year-End Rollover function in the General Ledger module is used to reset account balances for Income and Expense Accounts, and move the dollar amounts to your Retained Earnings, or other G/L Accounts. The Year-End Rollover can be completed when all other year-end activities and Journal Entries have been created.

You can also perform a Year-End Rollover more than once. For example, if you complete a Rollover early in your Fiscal Year but have to create some adjusting Journal Entries later, you can do another Year-End Rollover at a later time. Just be sure to use different information in the Reference field when performing multiple Year-End Rollovers.

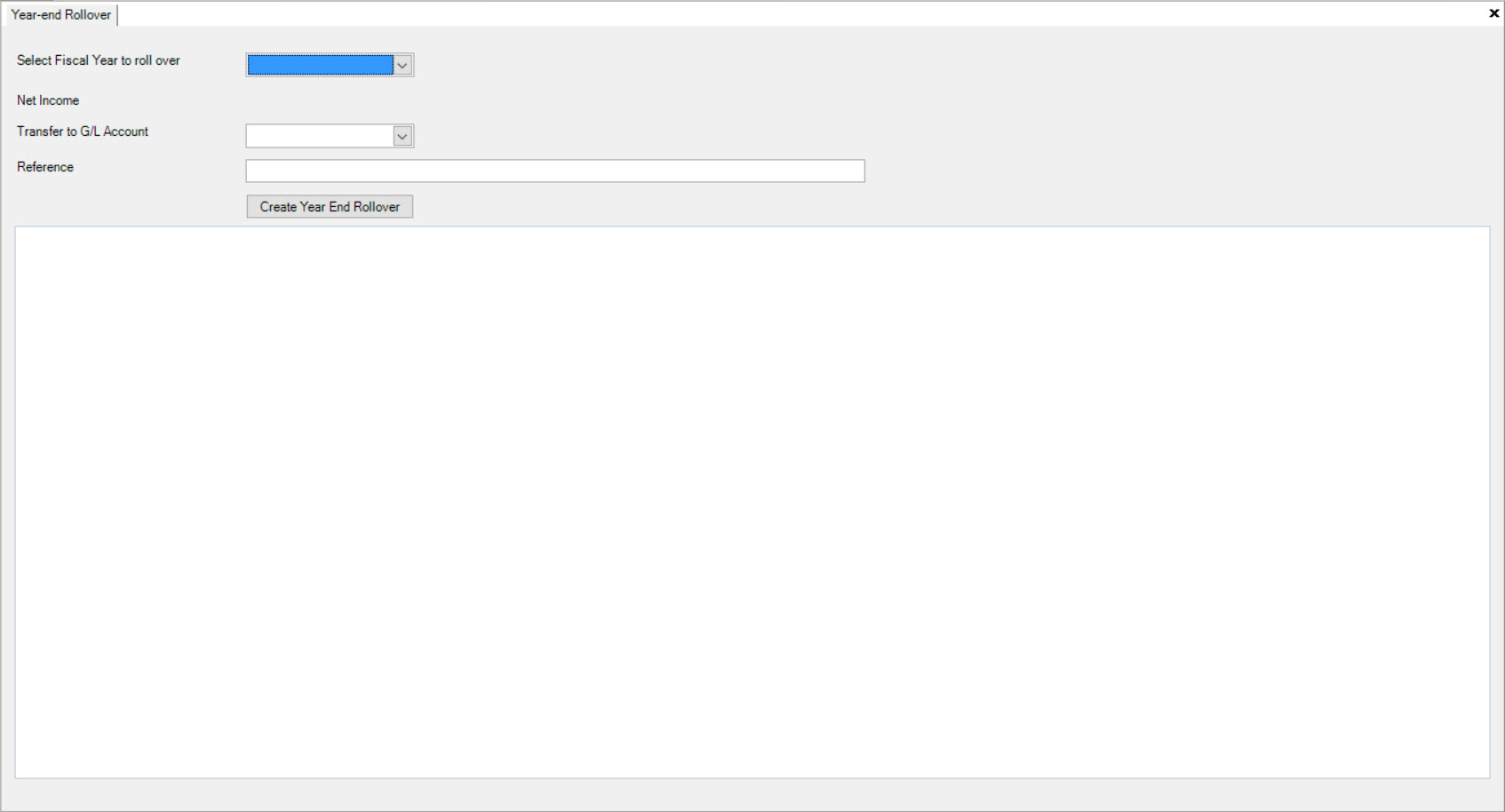

To begin a Year-End Rollover, navigate to the  tab and click on the

tab and click on the ![]() icon. The Year-End Rollover screen

will be displayed.

icon. The Year-End Rollover screen

will be displayed.

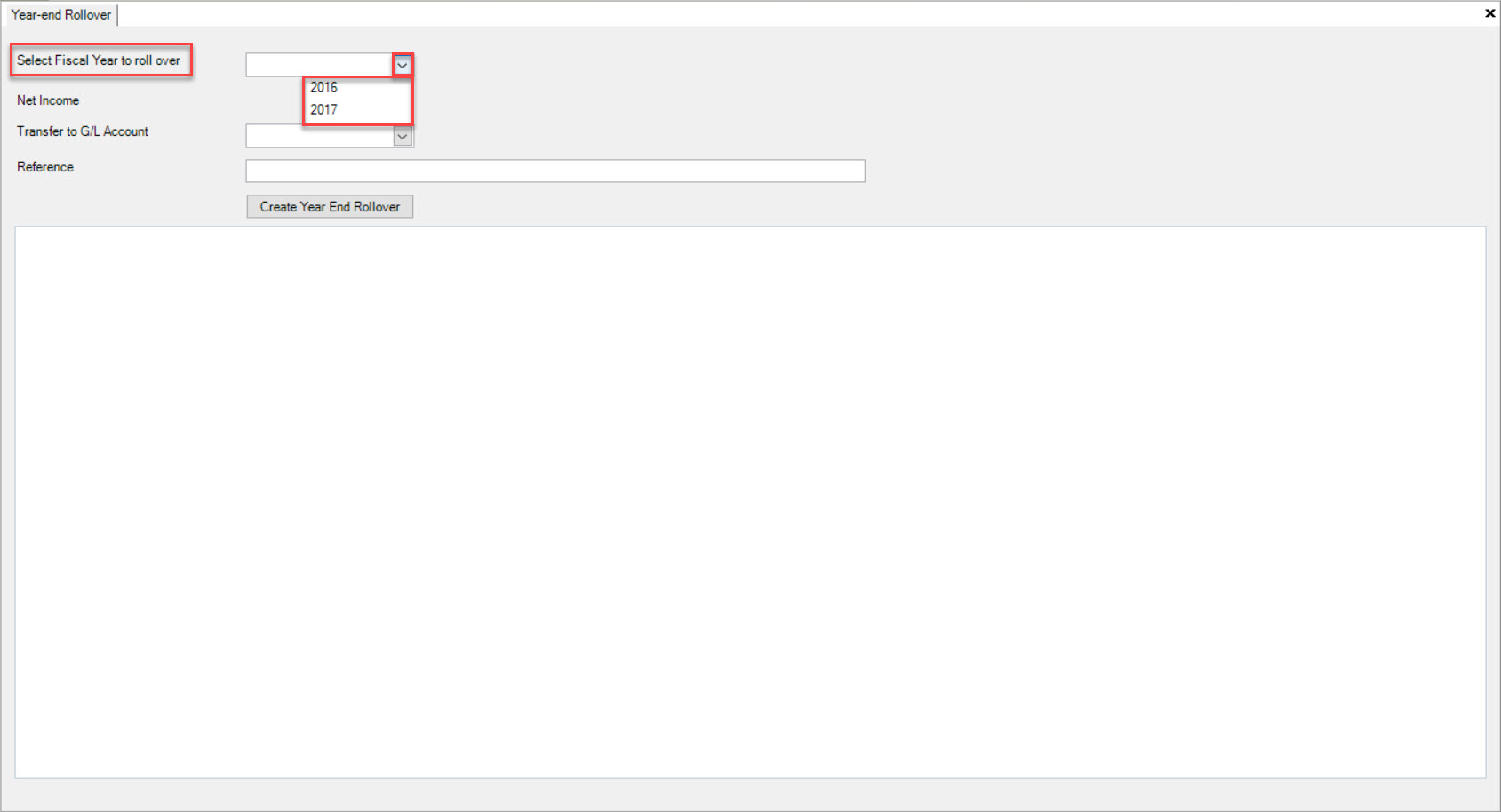

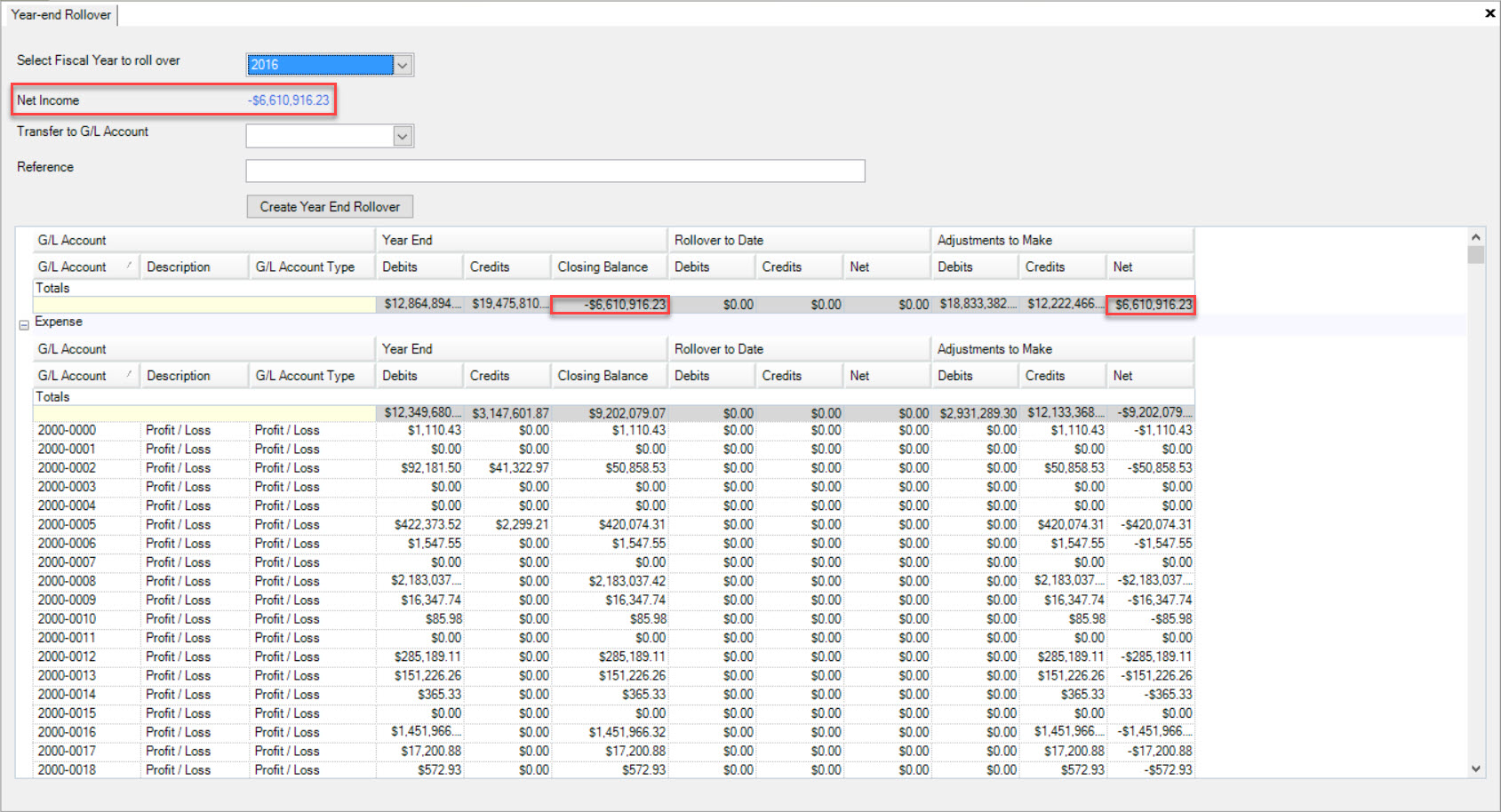

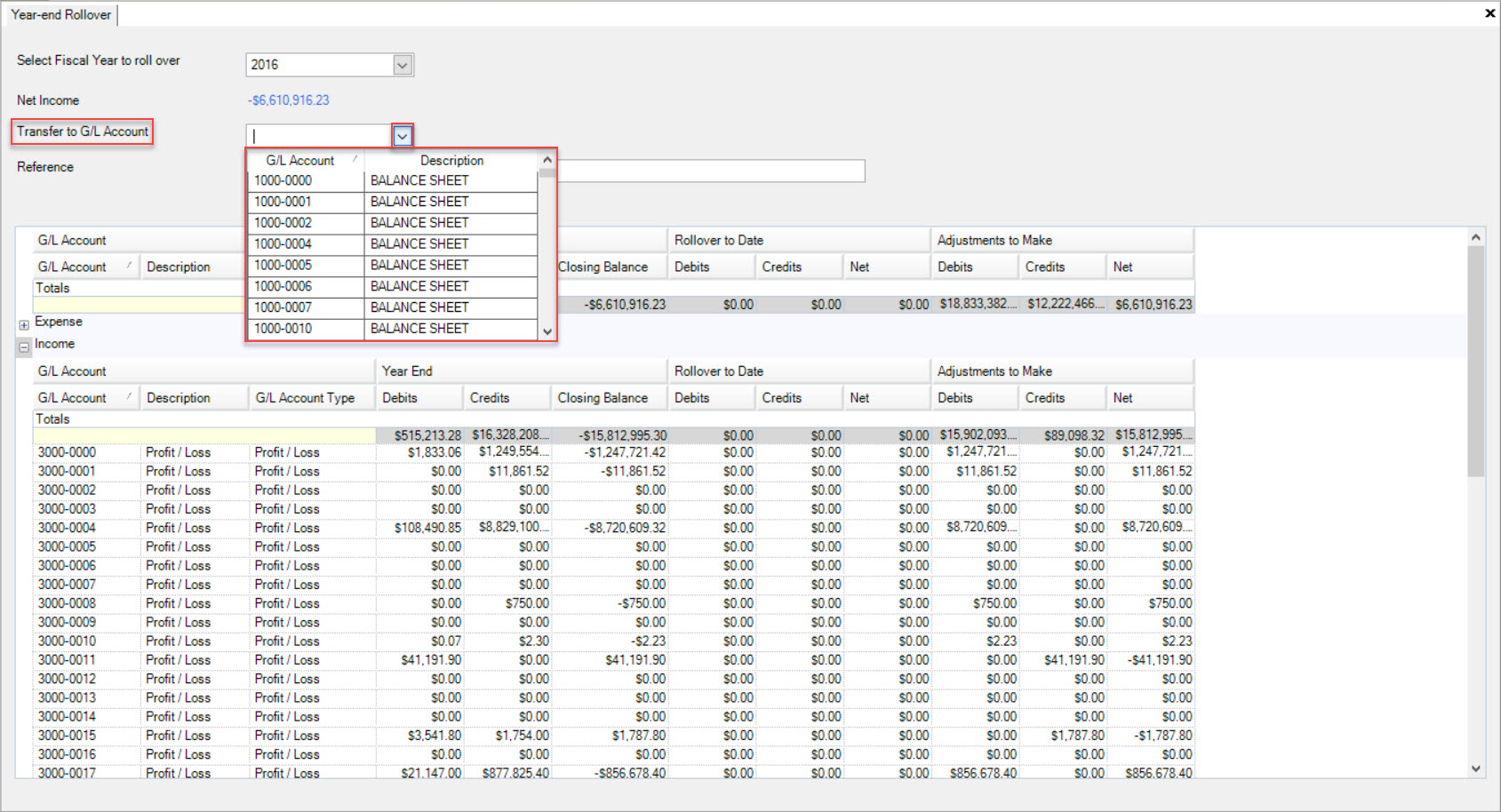

Select the Fiscal Year that you will be closing by using the drop-down menu provided. The Net Income from the Fiscal Year is the amount that will be rolled over to the next year and will be displayed once the Fiscal Year is selected.

Once you select the Fiscal Year, the Net Income amount that will be rolled over will be displayed. Verify that this is the correct amount before continuing.

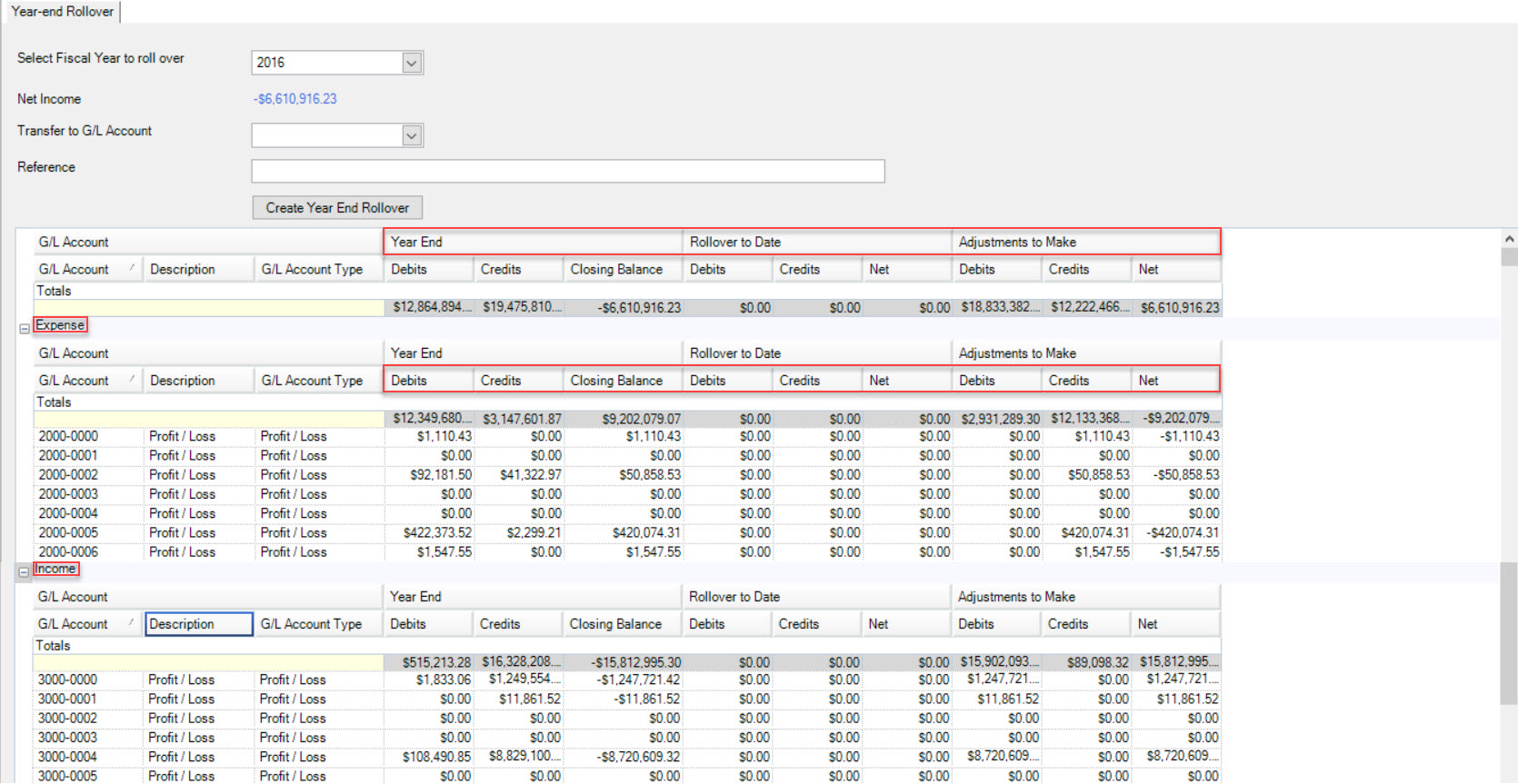

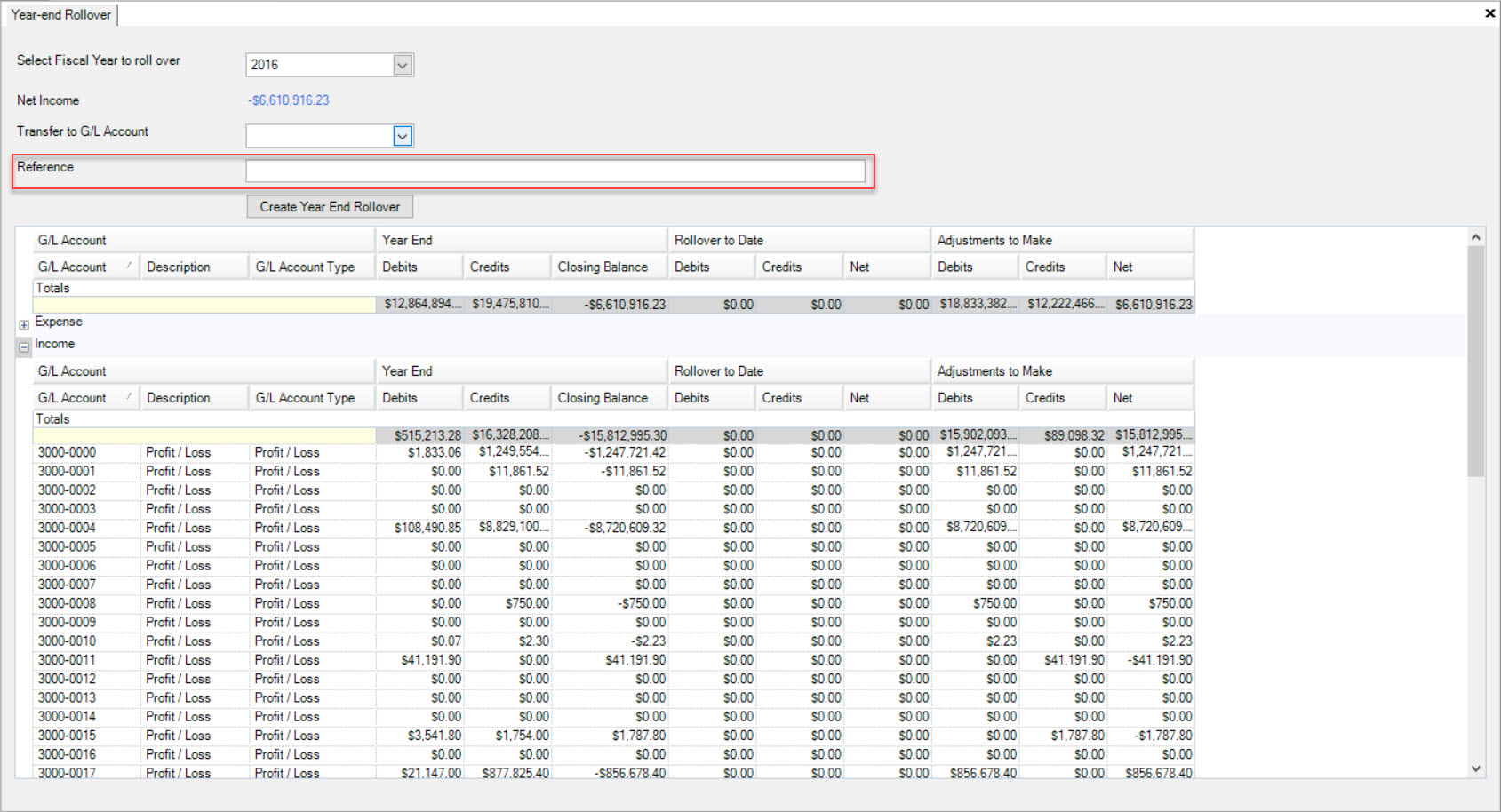

The details for each Expense and Income Account will also show on the screen. There are three sections to the right of the G/L Account: Year-End, Rollover to Date, and Adjustments to Make. In each section you will find columns for Credits, Debits, and either Closing Balance or Net. The Rollover to Date column will be updated once you have completed a Year-End Rollover.

Next, select the G/L Account to transfer the Net Income amount to, using the drop-down menu next to Transfer to G/L Account. Enter a meaningful Reference value. The Reference will show on the adjusting Journal Entry that is created when you complete a Year-End Rollover.

Finally, select the  button when you are ready to complete the Rollover.

button when you are ready to complete the Rollover.

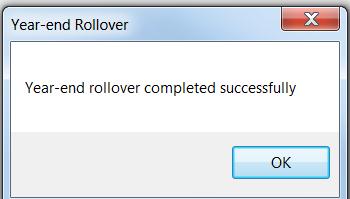

A Year-End Rollover confirmation window will appear, indicating the success of the Year-End Rollover.

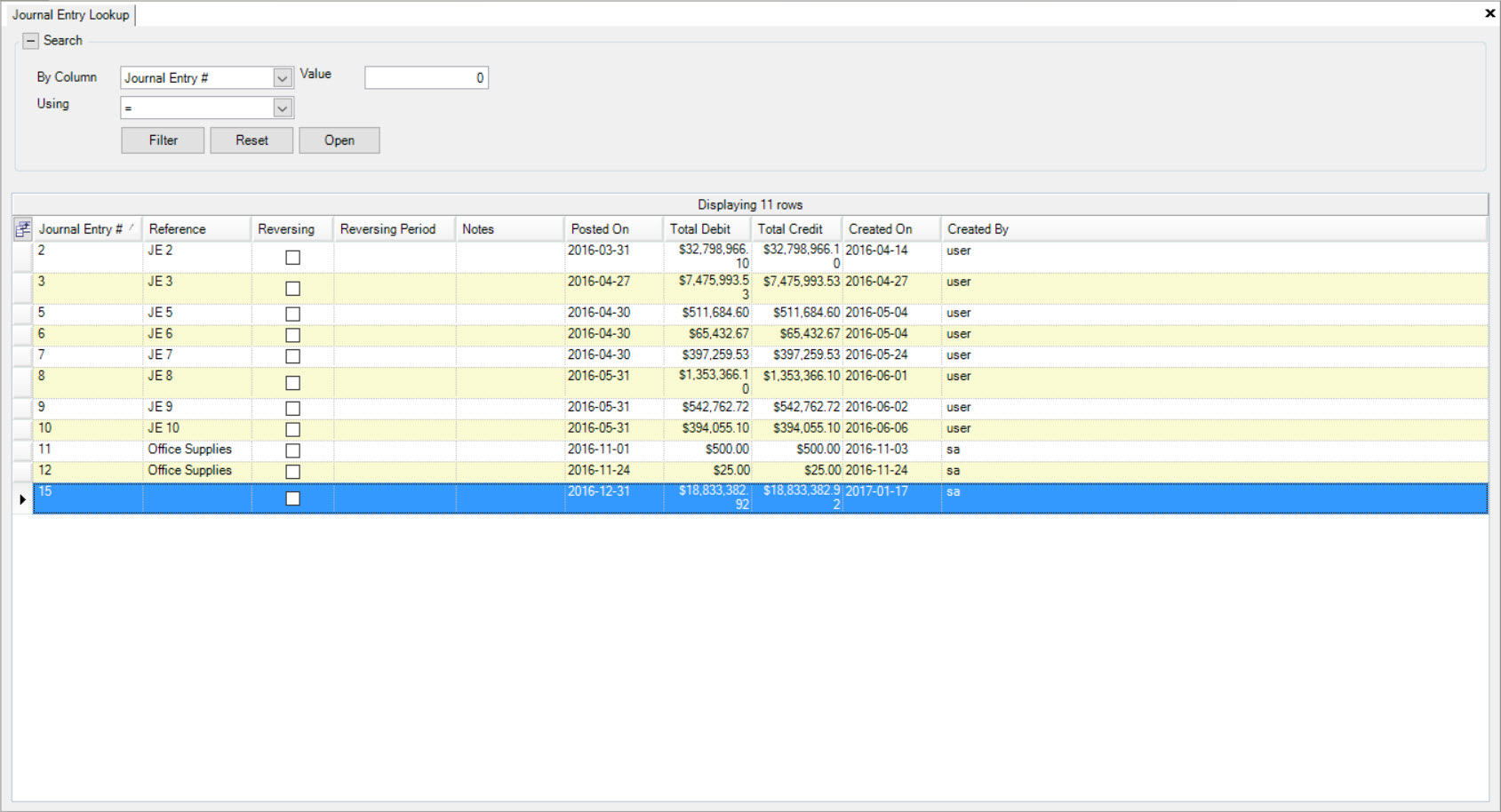

The system will create a Journal Entry with the adjusting Transactions so your Income and Expense G/L Account balances are set to zero for the new Fiscal Year. The Journal Entry will be posted to a

hidden Fiscal Period 13 in the system, but can be viewed by navigating to the  tab and clicking on the

tab and clicking on the ![]() icon. The

Journal Entries Lookup screen will be displayed where you can locate the Journal Entry for the completed Year-End Rollover.

icon. The

Journal Entries Lookup screen will be displayed where you can locate the Journal Entry for the completed Year-End Rollover.

Deleting a Year-End Rollover¶

In order to delete a Year-End Rollover, you need to delete the rollover Journal Entry.

To do so, navigate to the  tab and click on the

tab and click on the ![]() icon.

icon.

Locate the rollover Journal Entry you wish to delete and highlight the appropriate row. Click on the  button located at the top of the screen.

button located at the top of the screen.

The selected rollover Journal Entry will be deleted as well as the Year-End Rollover transactions that were created.

The Rollover to Date and Adjustments to Make columns will be adjusted on the Year-End Rollover screen.