Month-End Journal Entries¶

Journal entries are needed at month-end to account for inventory value in the ShopEdge system. Inventory transactions are not captured directly to the General Ledger as they happen. Instead, journal entries are created to capture the month’s inventory activity to the General Ledger. Several reports are used to compute the closing balance for each inventory asset account. Then, the journal entry is created in such a way so that the closing balances in the inventory accounts match with the value shown on the report.

Inventory journal entries can be created as reversing entries, or the journal entry can be made as an adjustment to the last month’s closing balance to bring each inventory account in line with the current month closing balances.

G/L Account Setup¶

The inventory reports can make use of G/L accounts linked to inventory items. Setting up the inventory G/L accounts makes creating the journal entries simpler, since the reports can be filtered, grouped, and summarized by G/L account.

Purchased Items¶

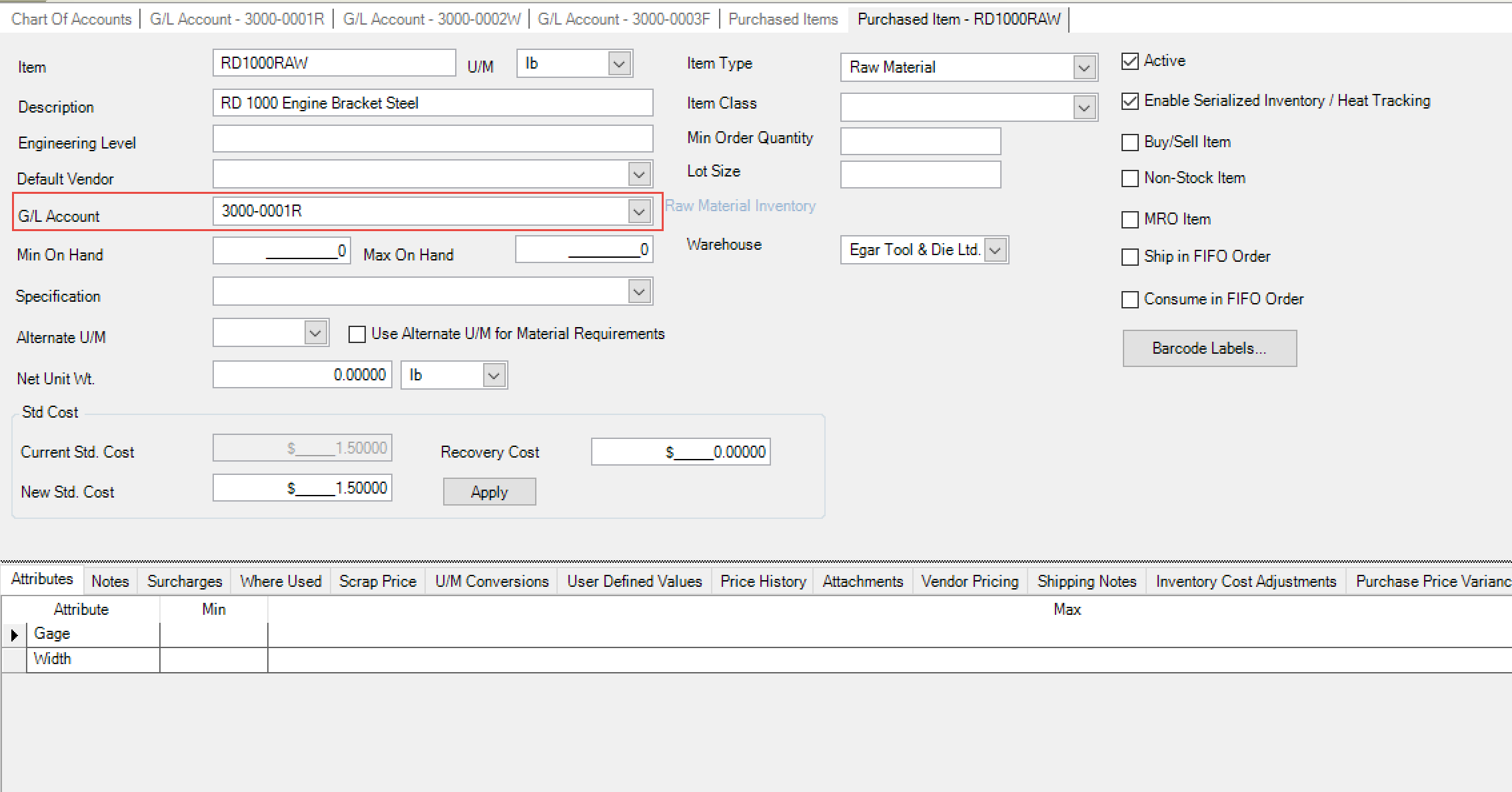

For purchased items (including raw material), the G/L account on the Purchased Item setup is used as the inventory account for the item. To access the Purchased Item screen, navigate to the Purchasing tab, and click on the Purchased Items icon.

Then, double-click the Purchased Item you wish to view to open it. The G/L account field is on the screen:

When you run the Inventory Valuation report, this is the inventory account that will be shown for the Purchased Item.

Finished Goods and WIP¶

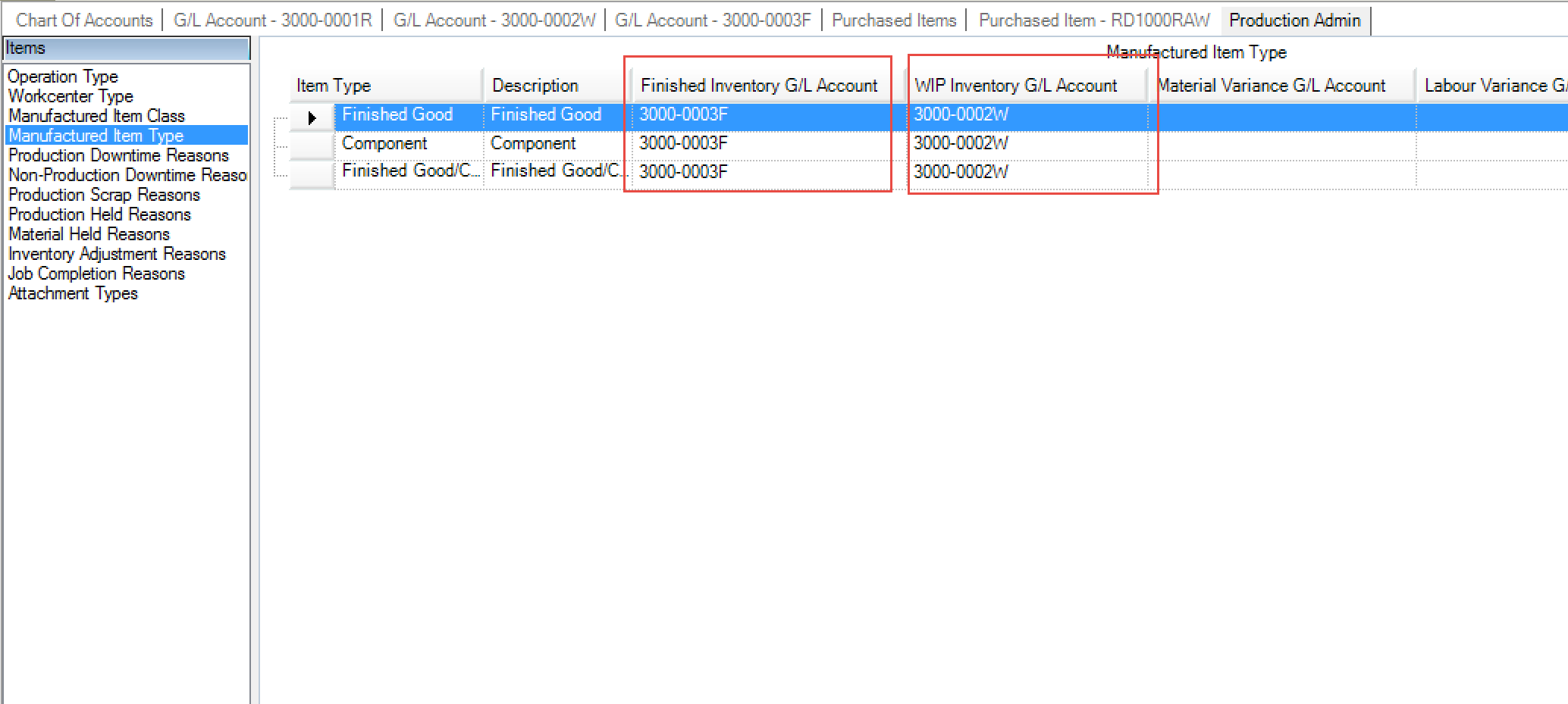

For manufactured items (both Finished Goods and WIP), you can set the inventory asset G/L Account on the Item Type. To access the Item Type screen, go to Production, then click on the Admin icon:

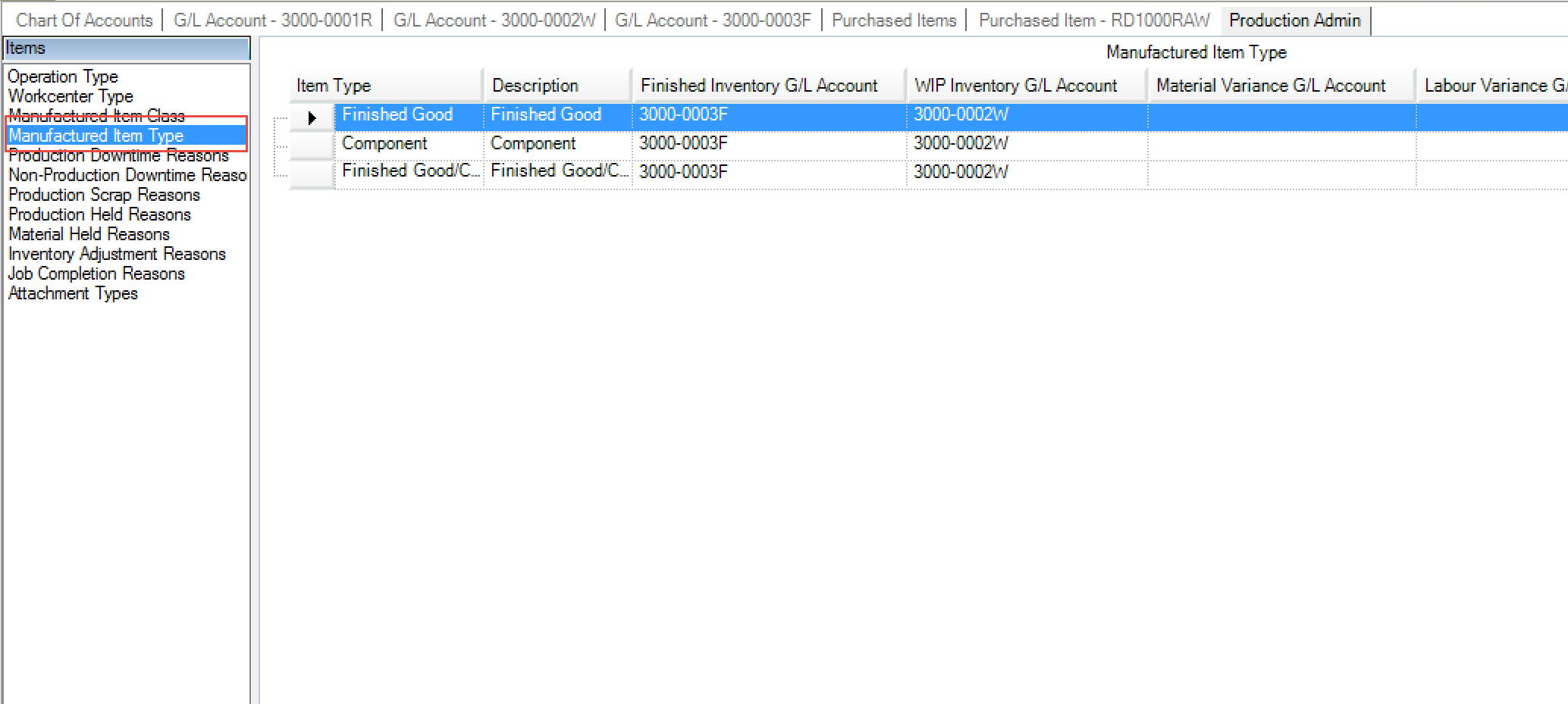

From the list, select Manufactured Item Types:

For each item type, you can specify the inventory asset G/L account to use for WIP, and for Finished Goods. The WIP inventory G/L account is used for inventory at the operation level. The Finished Goods inventory account is used for inventory that is at the item level. For component parts, if you want all inventory to be considered WIP (either inventory at the item level, or at an operation level), then set the Finished Goods and WIP inventory G/L accounts for the component Item Type to be the WIP inventory asset G/L Account.

When you run the Inventory Valuation report, the WIP and Finished Goods G/L Accounts will be displayed for each item and operation shown on the report.

Accruals for Non-Invoiced P/O Receipts¶

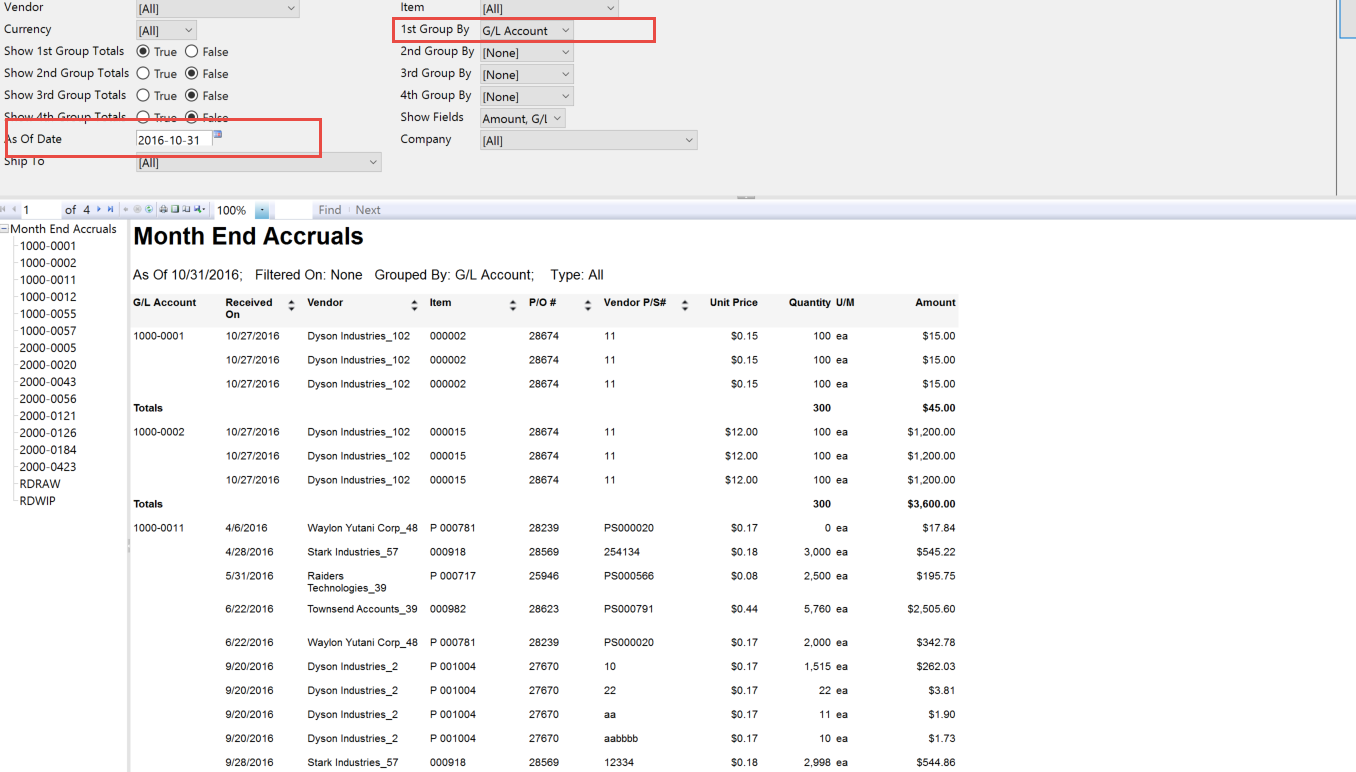

The Month-End Accrual report is used to capture the accrual amount into your Accrual Liability G/L account. This account records the liability amount due to your vendors for the inventory you have received, but not yet invoiced.

The report can be run for a particular posting date (based on the Received On date of the receipt). It will show the receipts not yet invoiced as of the posting date selected. The total amount of the accrual will show as a grand total at the end of the report. The report can group by G/L account to show the amount that must be accrued for each inventory asset or expense account (for non-stock and expensed items).

Enter the Posting Date and set the 1st Group By to be G/L Account. Then click View Report to view the report:

The total accrual amount will show as the grand total under the Amount column. This is the amount to credit to your Accrued Liabilities G/L account. For each G/L account shown under the G/L Account column, a total will be displayed. This is the amount to debit to each of your expense or inventory accounts as part of the accrual.

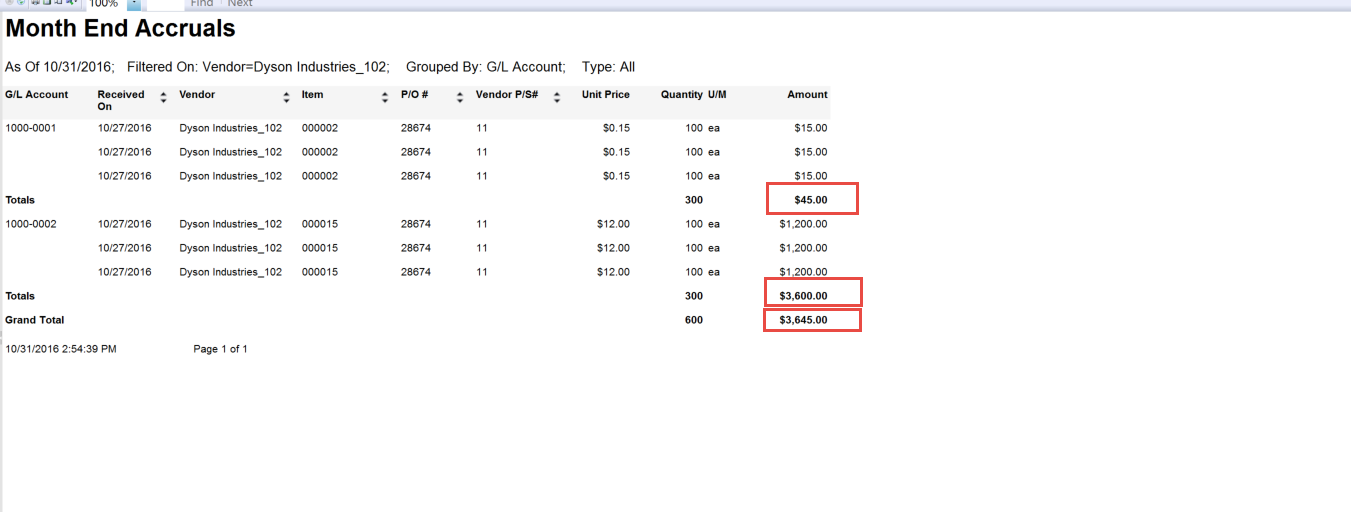

As an example, suppose we run the accrual report for the period ending October 31. The following results are show on the report:

Our report has a grand total Amount of $3,645.00, and shows total amounts for G/L account 1000-0001 of $45.00 and G/L account 1000-1002 of $3,600.00. These are the amounts that should be showing as closing balances in our accounts as of the Posting Date we selected. Our accrual journal entry is as follows:

| G/L Account | Debit | Credit |

|---|---|---|

| Accrued Liability | $3,645.00 | |

| 1000-0001 | $45.00 | |

| 1000-0002 | $3,600.00 |

It is easiest if the accrual journal entry is entered as a reversing journal entry that reverses out of the next period. That way, each month the journal entry is created directly from the amounts on the accrual report, so that the closing amounts in the G/L accounts match to the report.

Cost of Goods Sold¶

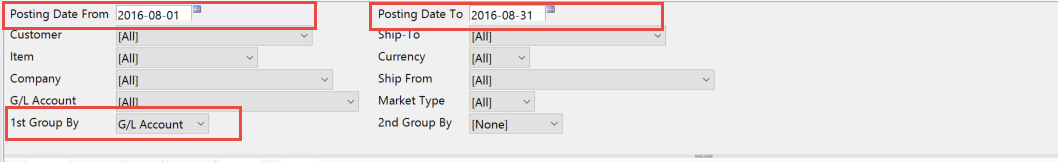

The Cost of Goods Sold report displays the Cost of Goods expense amount for the period. This amount is debited to the Cost of Goods Sold G/L account, and credited to the Finished Goods inventory asset account. This report is run for a particular date range based on the Posting Date of the invoice. So, to capture the Cost of Goods Sold for the period, the Posting Date From parameter should be the first day of the month, and the Posting Date To parameter should be the last day of the month. The 1st Group By parameter should be set to G/L Account to get totals for each of the inventory asset accounts that are to be credited.

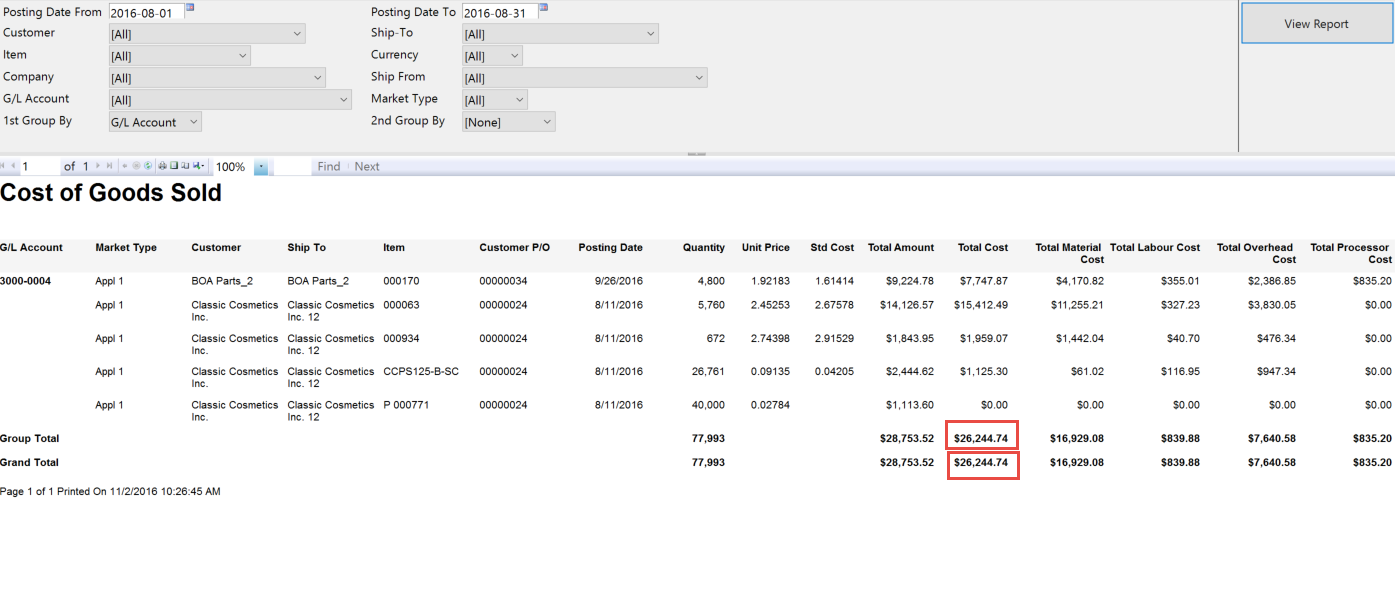

As an example, suppose we want to capture the Cost of Goods Sold for the month of August. We set the Posting Date From parameter to August 1st, and the Posting Date To parameter to August 31. Then, we set the 1st Group By parameter to G/L Account, so we get totals for each inventory asset account:

When we view the report, we get the following results:

The report has a grand total Total Cost amount of $26,244.74. This amount represents the total Cost of Goods Sold amount for the period. We can also see that, for our Finished Goods inventory asset account 3000-0004, we have a total amount of $26,244.74. This represents the total amount of Finished Goods inventory to credit the Finished Goods inventory asset account by. With this example, our Cost of Goods Sold journal entry for month-end becomes:

| G/L Account | Debit | Credit |

|---|---|---|

| Cost of Goods Sold | $26,244.75 | |

| 3000-0004 | $26,244.75 |

Inventory¶

The Inventory Valuation report is used to show the inventory value as of a particular posting date. The totals shown on the report represent the amounts that should be in the inventory asset G/L accounts as of the posting date selected on the report. An adjustment has to be posted to each inventory asset account so that the closing balances in each of the accounts match exactly to what the Inventory Valuation report shows. To put it another way, if the inventory valuation is journaled at each month end, and we are trying to close out the current month, the inventory asset accounts will still be showing the closing balances as of last month. The amounts shown on the Inventory Valuation report represent the current month’s closings amounts. So, if we are make an adjustment such that the closing amounts must match the report, then we will post an amount that is the difference between this month’s closing amount, and the current amount showing in the asset account.

Also, for each adjusting amount that we post to our inventory asset G/L account, we must post an offsetting amount into an Inventory Change expense G/L account. This amount represents the expenses related to our inventory change, such as Inventory Adjustments, Scrap, and Material Usage and Labour variances against the cost of production.

As an example, suppose we have a Raw Material inventory account 3000-0001R showing a current balance of $10,000.00, a WIP inventory account 3000-0002W with a current balance of $1,200,500.00, and a Finished Goods inventory account 3000-0003F with a current balance of $1,600,000.00. We wish to record inventory at our month-end October 31st.

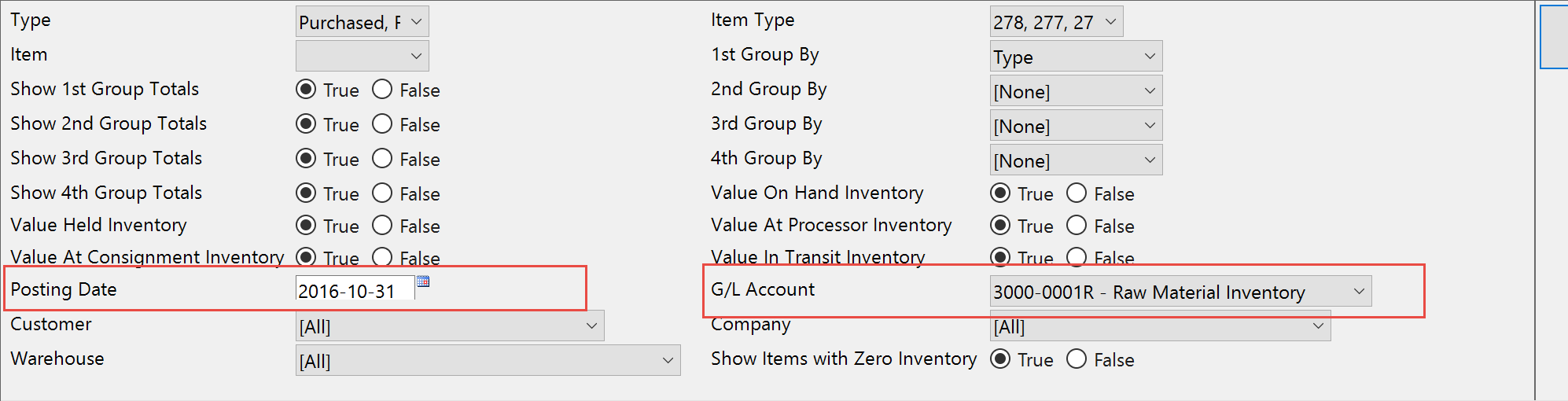

We run the Inventory Valuation report with a Posting Date value of our month-end date of October 31st. We can then run the report for each G/L account separately, by selecting the G/L account using the G/L Account parameter, or we can run the report for all items, and use the 1st Group By parameter and set it to G/L Account to get totals for each account. In this example, we run the report for each G/L account separately, and scroll to the end of the report to get the account totals.

First, we run the report for our Raw Material account 3000-0001R:

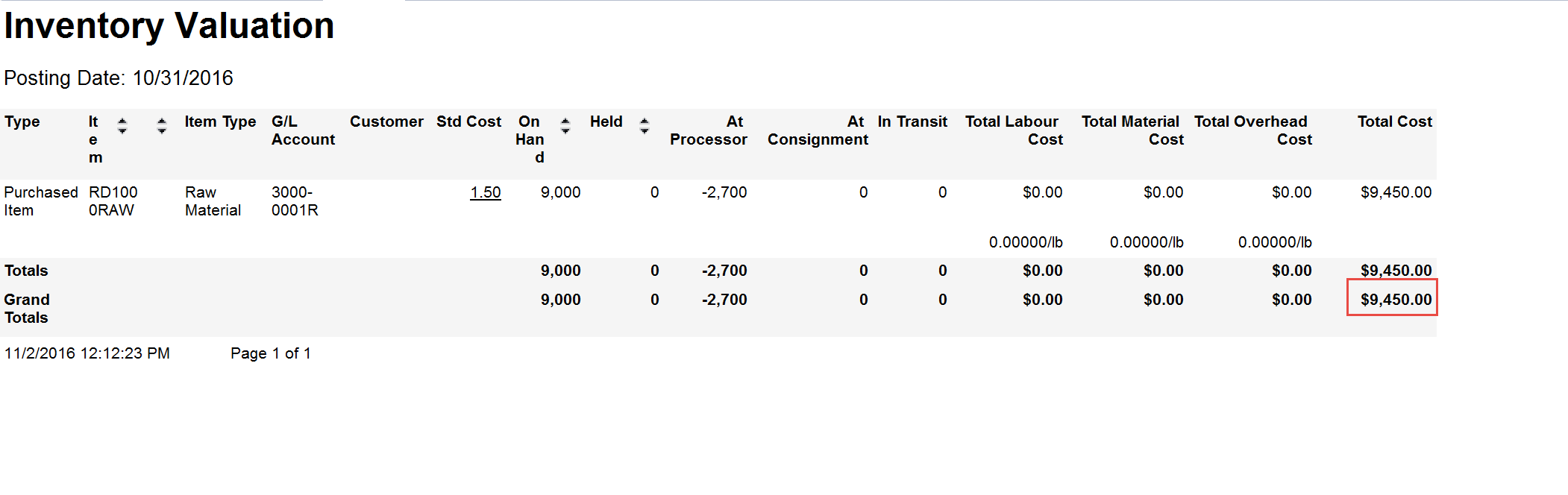

Click View Report to get the result. Scroll to the end of the report to get the closing balance for the Raw Material asset account. The report shows a total of $9,450.00:

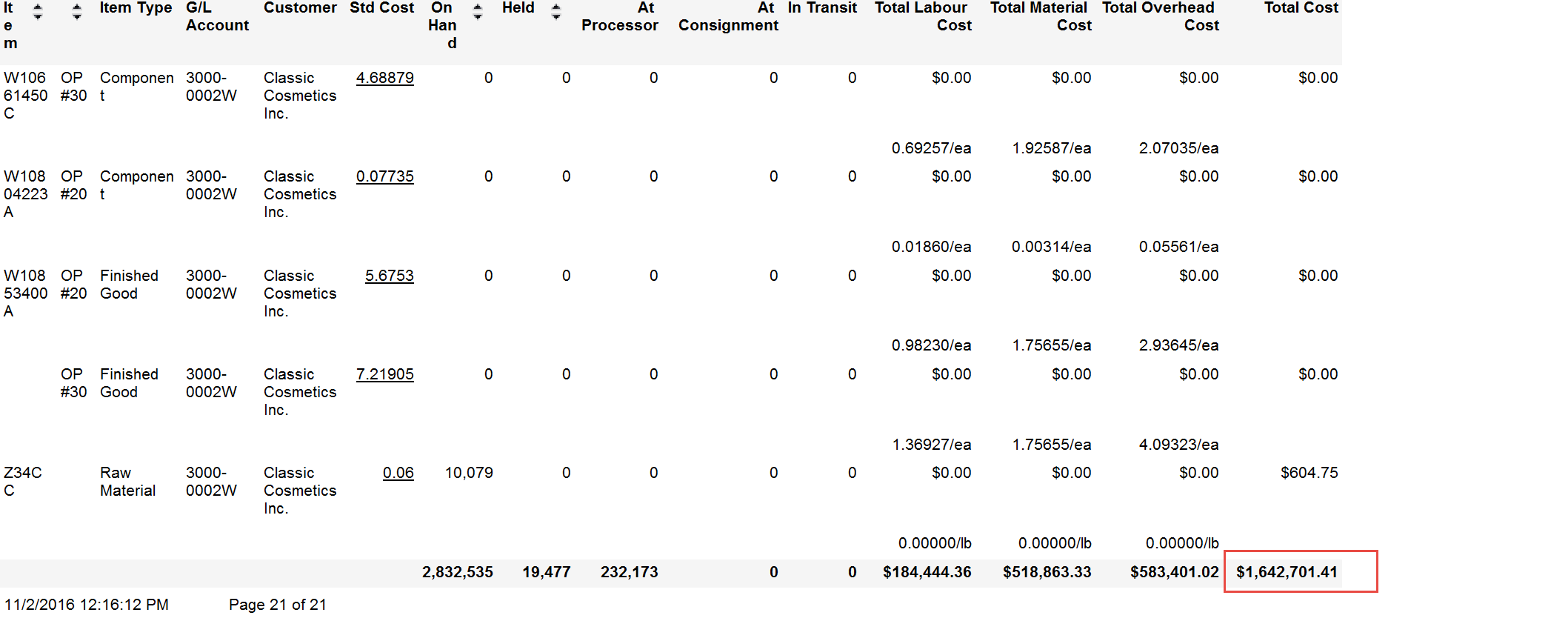

We then run the report for our WIP inventory account 3000-0002W and get the account closing balance of $1,642,701.41:

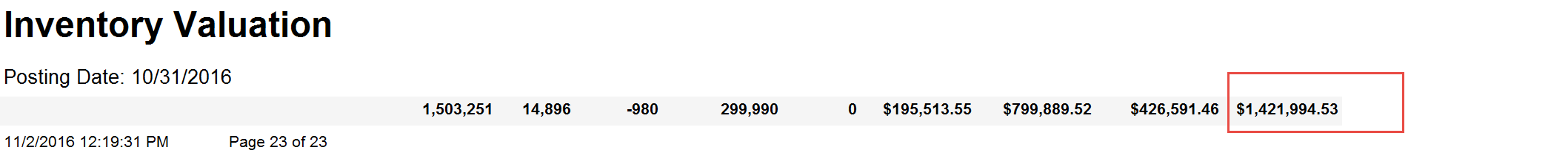

Finally, we run the report for our Finished Goods account 3000-0003F and get the account closing balance of $1,421,994.53:

With the final results, we can now start creating the journal entry. The first thing we need to do is calculate the adjustment amounts we will be posting to our inventory accounts. We need to compare the current period’s closing amounts to the current account balances to get the adjustment amount we need to post to make the account’s closing balance match the Inventory Valuation. We do this by simply subtracting the current account balances from the new closing amounts:

| G/L Account | Current Balance | Month End Closing Balance | Amount to Post |

|---|---|---|---|

| 3000-0001R | $10,000.00 | $9,450.00 | $9,450.00 - $10,000.00 = -$550.00 |

| 3000-0002W | $1,200,500.00 | $1,642,701.41 | $1,642,701.41 - $1,200,500.00 = $442,201.41 |

| 3000-0003F | $1,600,000.00 | $1,421,994.53 | $1,421,994.53 - $1,600,000.00 = -$178,005.47 |

Now that we have the adjustment amount that will bring our inventory accounts to the new closing balances, we can create the journal entry:

| G/L Account | Debit | Credit |

|---|---|---|

| 3000-0001R | $550.00 | |

| 3000-0002W | $442,201.41 | |

| 3000-0003F | $178,005.47 | |

| Inventory Change | $263,645.94 |