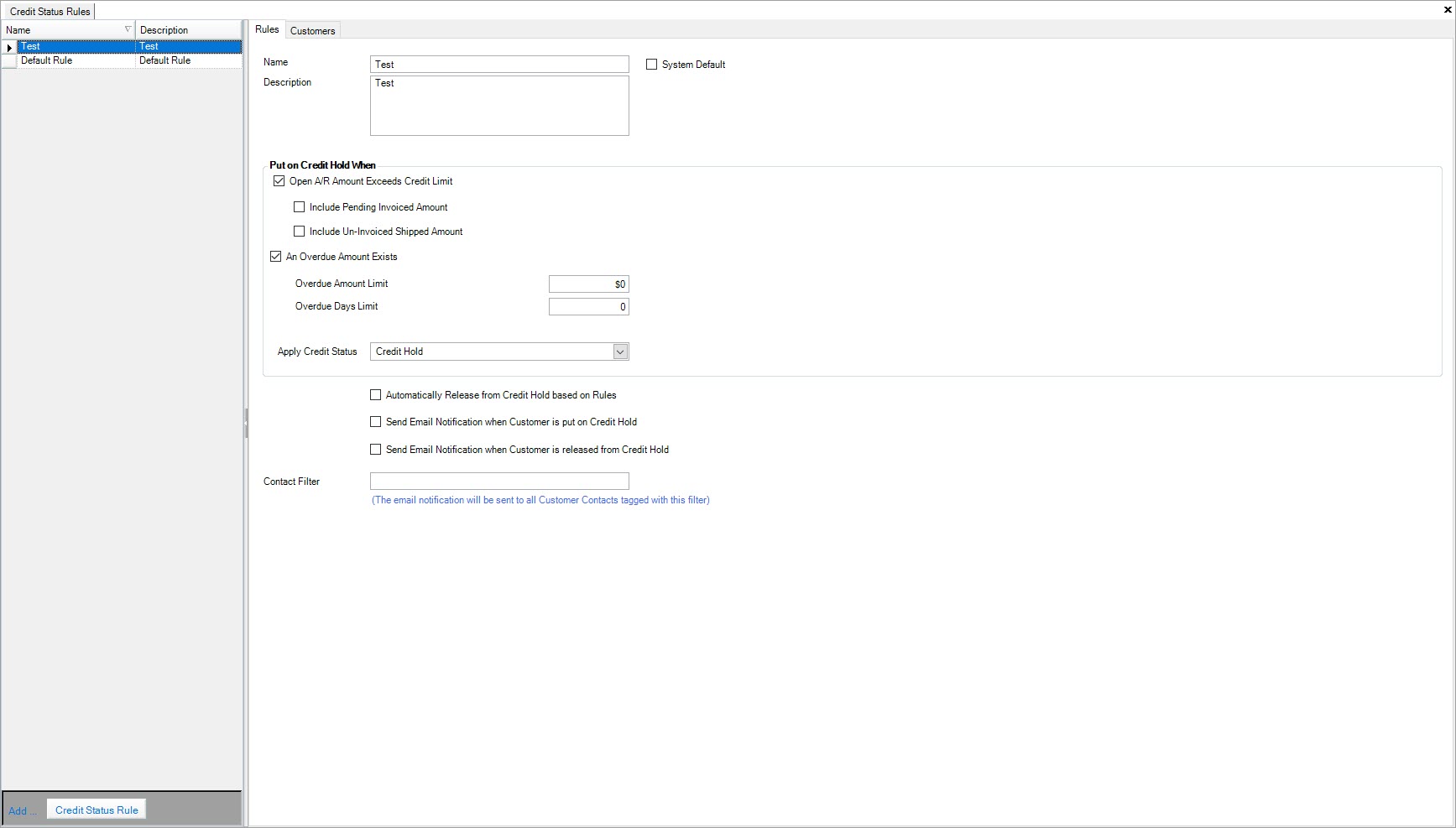

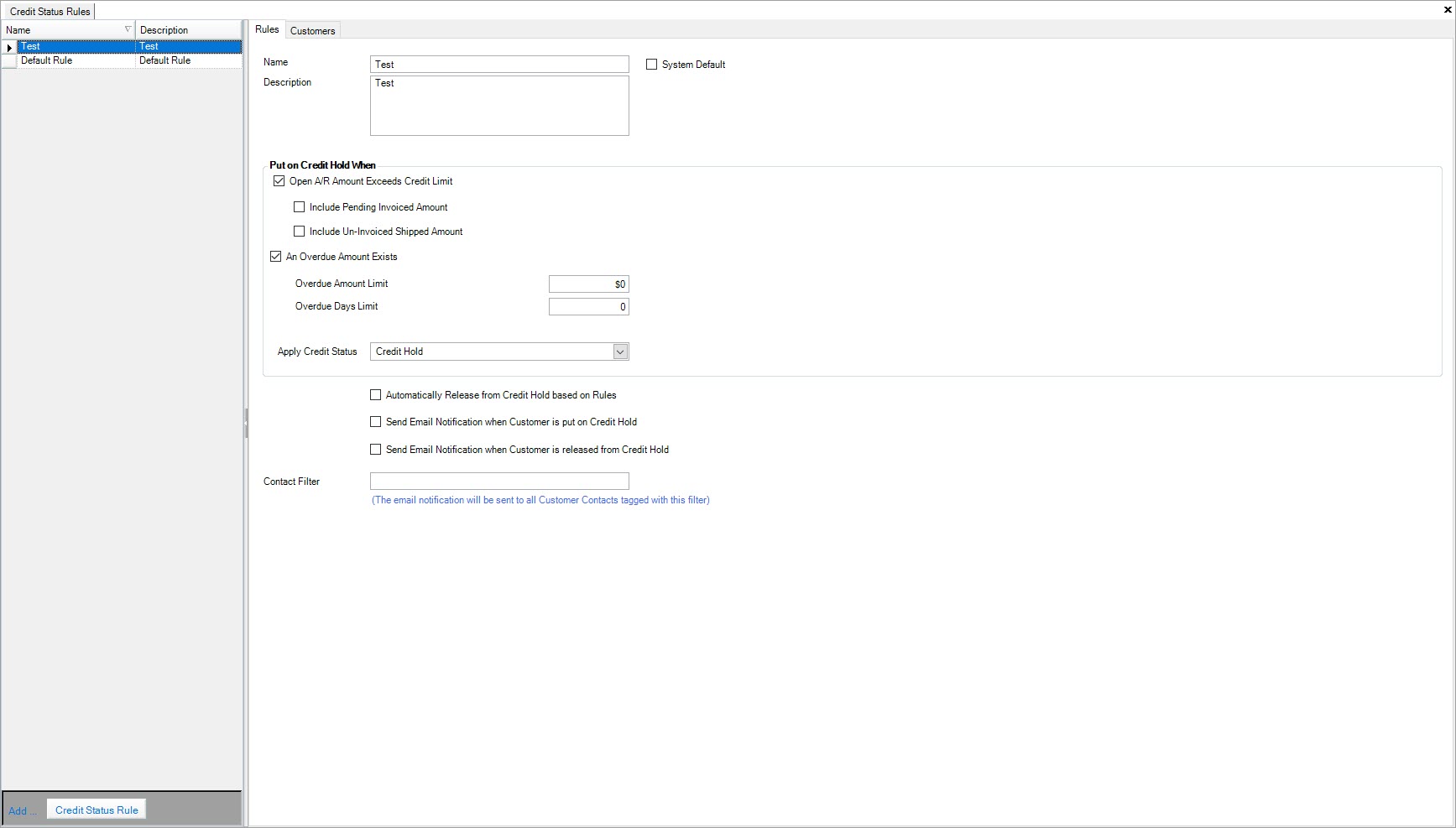

Credit Status Rules¶

Viewing Credit Status Rules¶

To view Credit Status Rules in the system, navigate to the  tab and click on the

tab and click on the  icon. The

Credit Status Rules screen will appear.

icon. The

Credit Status Rules screen will appear.

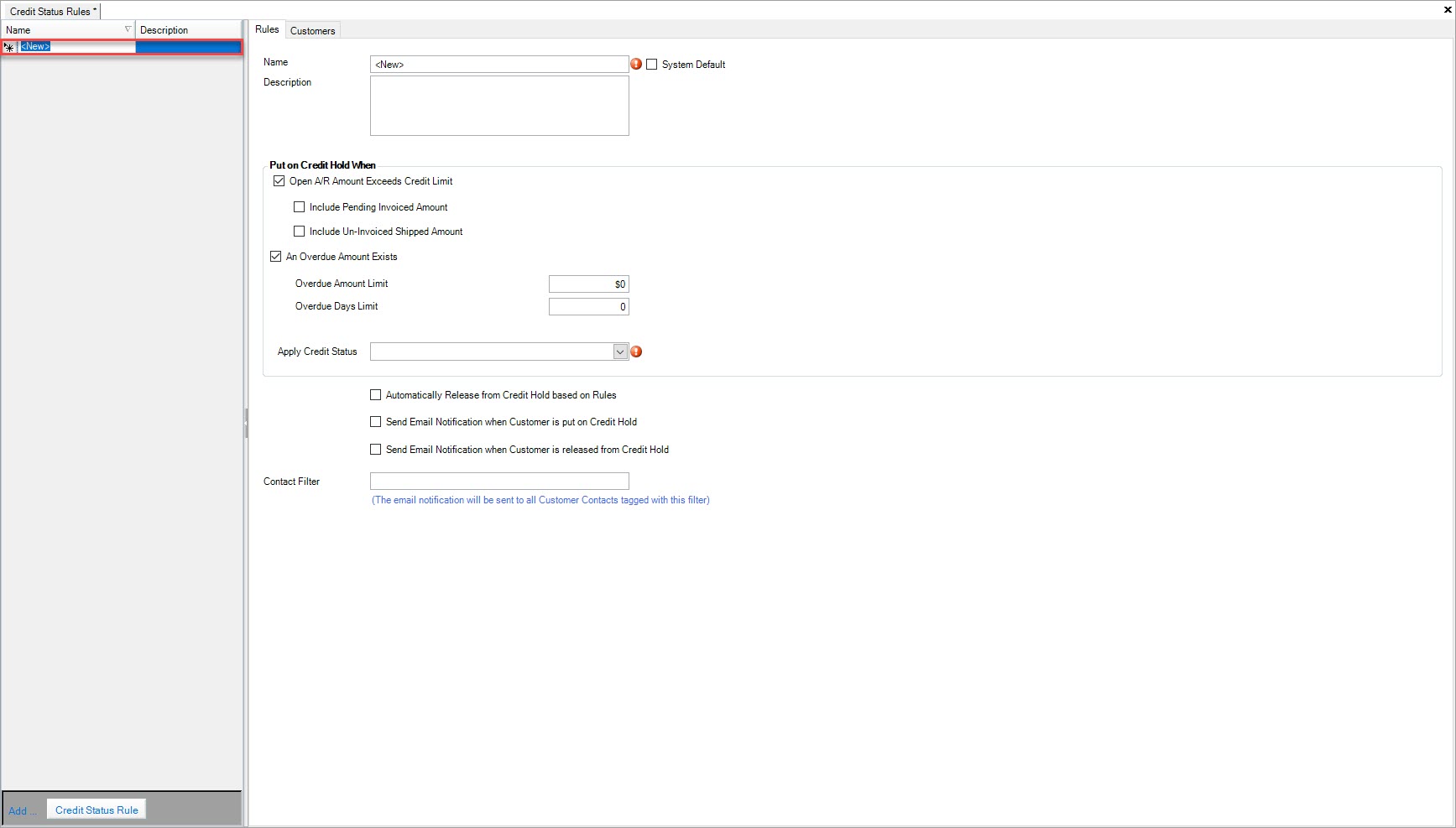

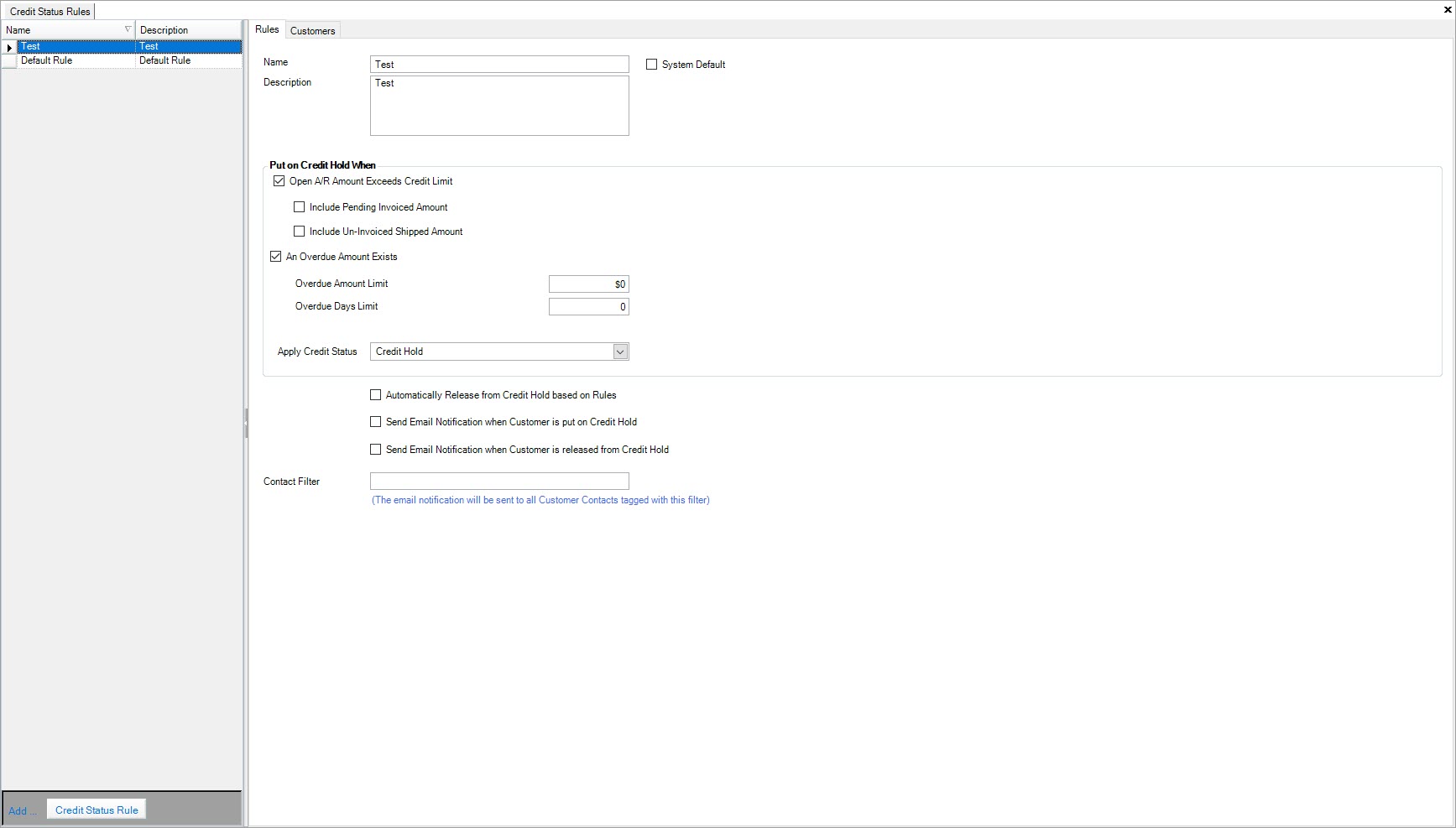

Creating a Credit Status Rule¶

To create a Credit Status Rule, navigate to the  tab and click on the

tab and click on the  icon. The

Credit Status Rules screen will appear.

icon. The

Credit Status Rules screen will appear.

Located in the bottom-left corner, select the  button.

button.

A new row will appear where users can enter in a Name and Description either on the Credit Status Rule line item or under the  tab to the right of the

screen.

tab to the right of the

screen.

Note

Each Credit Status Rule that is created must have a unique Name; there cannot be two named the same.

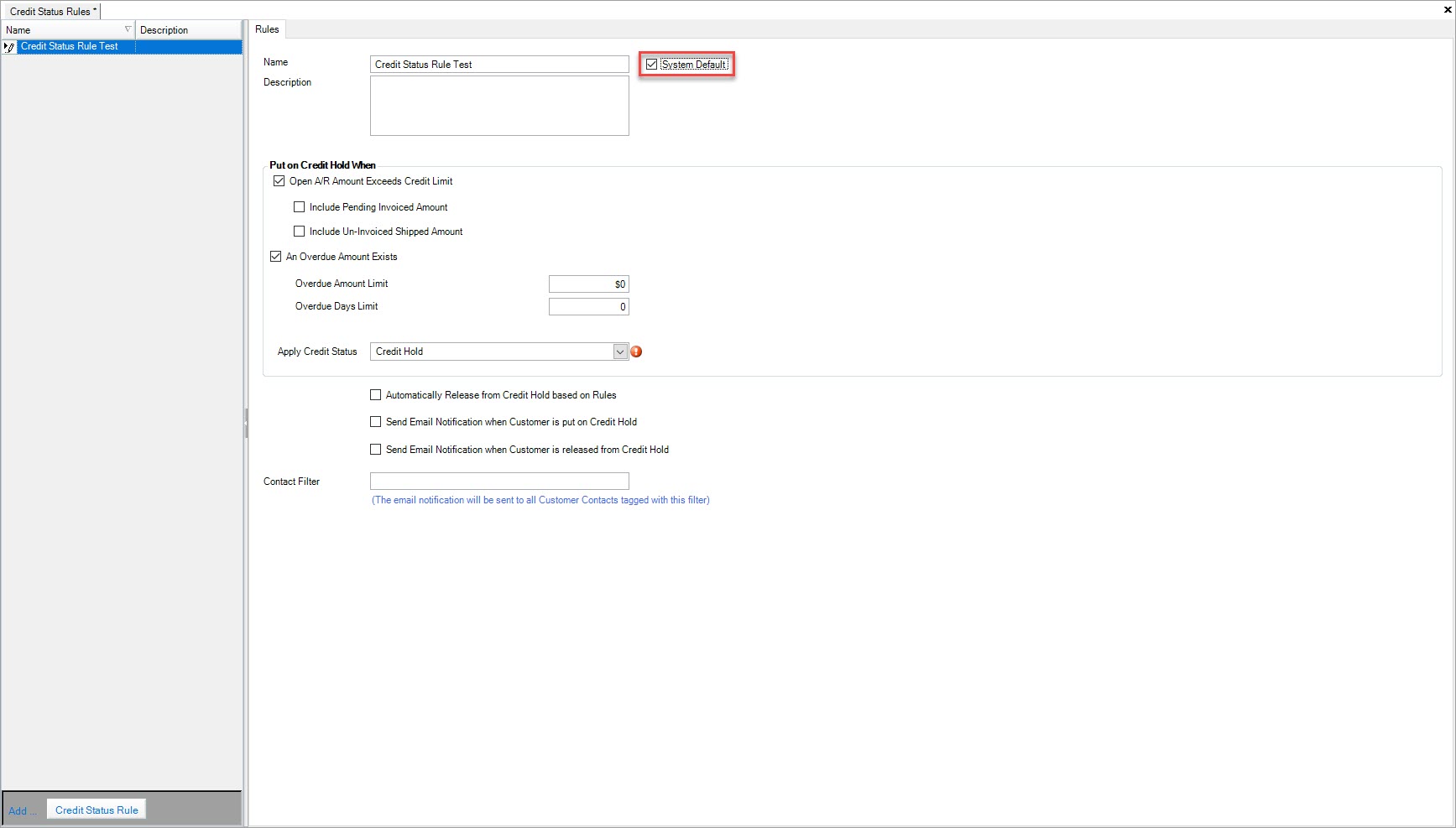

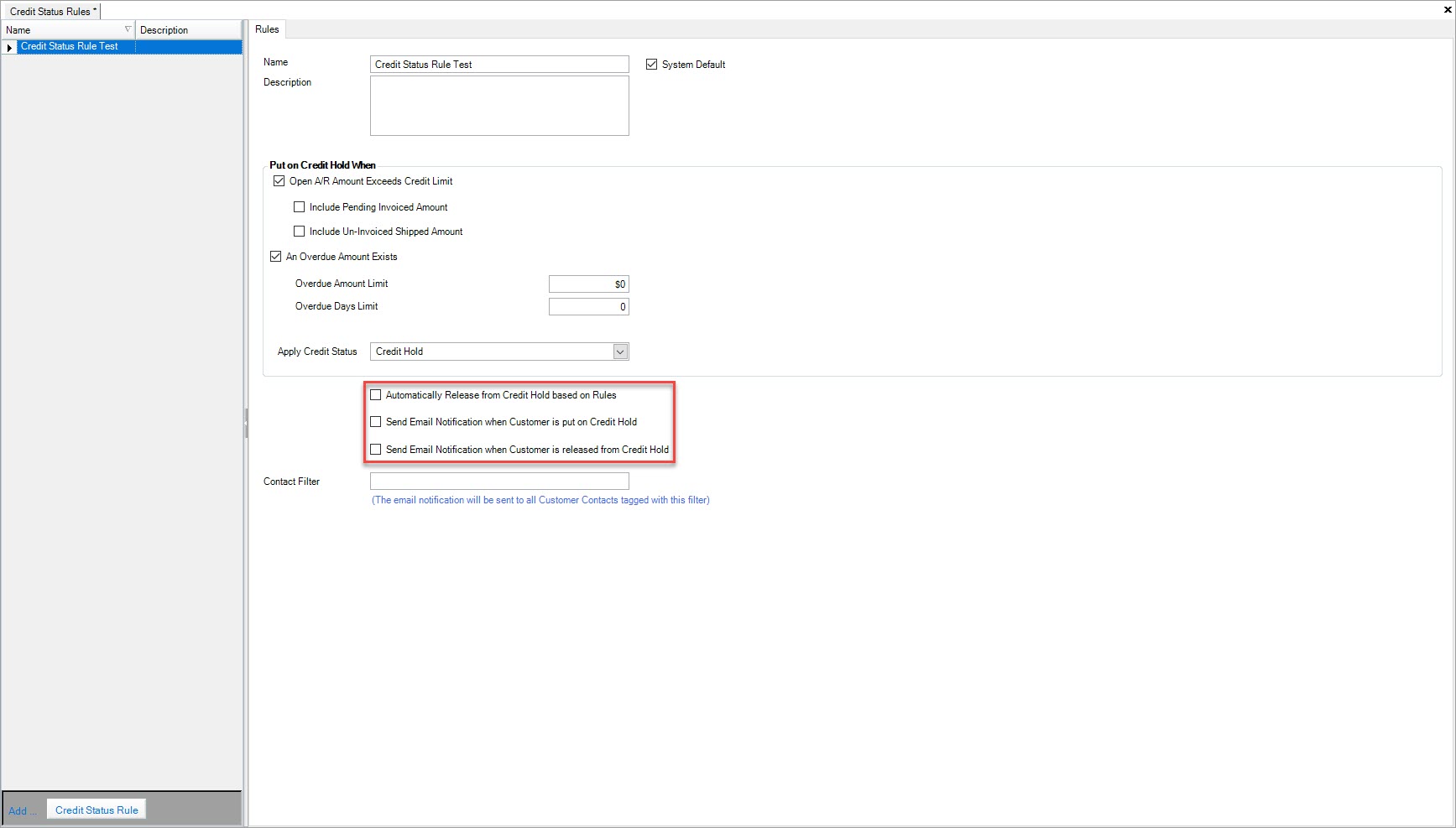

Under the  tab, users can make the Credit Status Rule a system default by selecting the checkbox. This will make all Customers in the system default to

this Credit Status Rule.

tab, users can make the Credit Status Rule a system default by selecting the checkbox. This will make all Customers in the system default to

this Credit Status Rule.

Note

There is only allowed to be one Credit Status Rule set as the system default.

If users do not wish to set a Credit Status Rule as the system default, then they can add specific Customers under the  tab that the Credit

Status Rule will apply to.

tab that the Credit

Status Rule will apply to.

For both system default Credit Status Rules and ones that are not set as the system default, users have the ability to set specific rules.

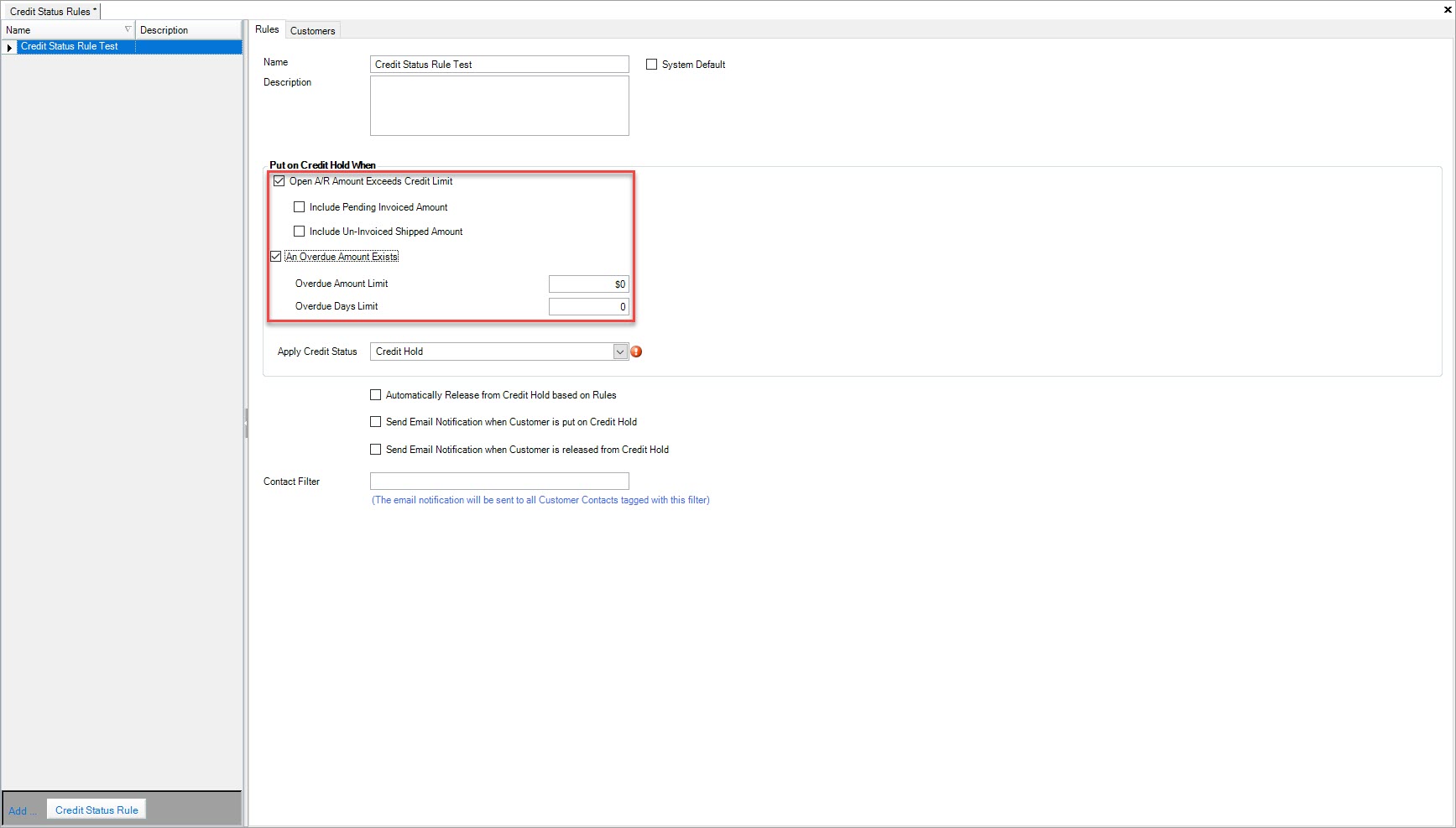

Under the  tab, under the Put on Credit Hold When section, users can select or de-select the Open A/R Amount Exceeds Credit Limit option. When this

option is selected, users can then select or de-select two other options: Include Pending Invoiced Amount and/or Include Un-Invoiced Shipped Amount.

tab, under the Put on Credit Hold When section, users can select or de-select the Open A/R Amount Exceeds Credit Limit option. When this

option is selected, users can then select or de-select two other options: Include Pending Invoiced Amount and/or Include Un-Invoiced Shipped Amount.

Users can also select or de-select the option An Overdue Amount Exists. When this option is selected, users can then select or de-select two other options: Overdue Amount Limit and/or Overdue Days Limit.

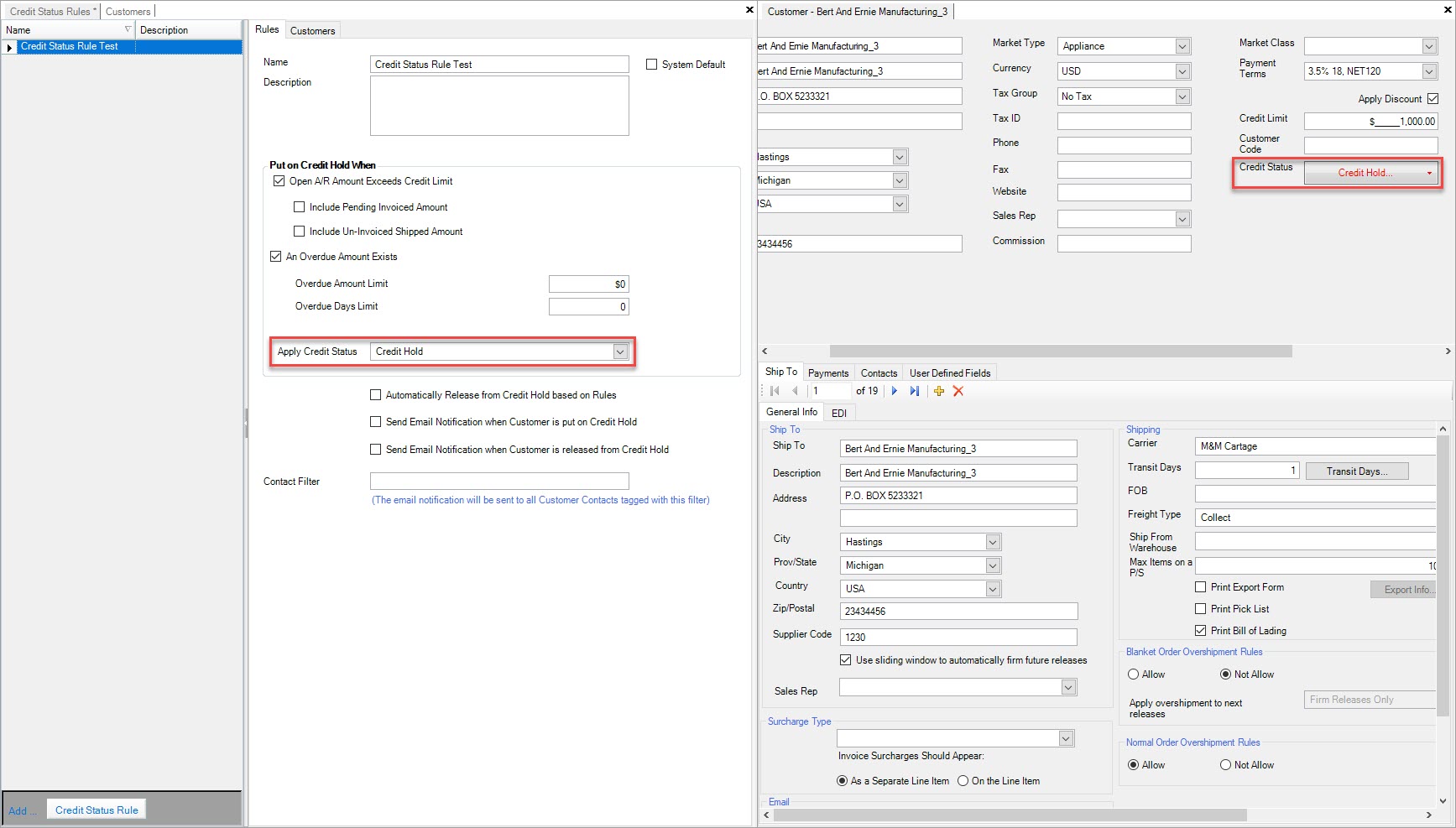

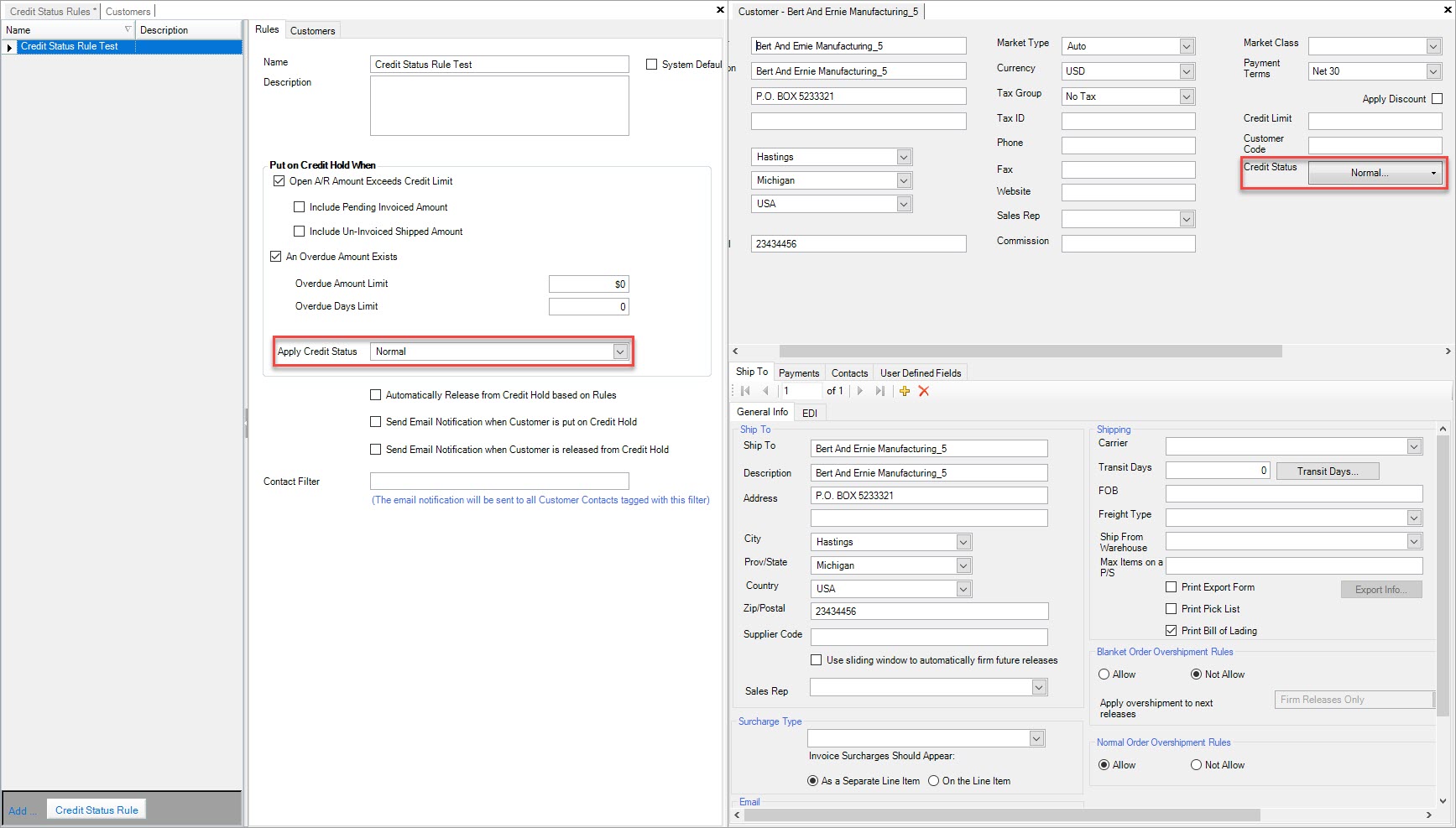

Once the above rules have been selected, users must select a status to appear when the Credit Hold is enabled. The two status options are Credit Hold or Normal. This status will appear on the Customers screen in the header information next to the Credit Status.

Users can also select or de-select the following options:

- Automatically Release from Credit Hold based on Rules

- Send Email Notification when Customer is put on Credit Hold

- Send Email Notification when Customer is release from Credit Hold

Note

When the above rules are selected, users must enter in a Contact Filter which will help the system to identify which Customers will receive an email notification.

Once the necessary information is completed, make sure to save before exiting the screen.

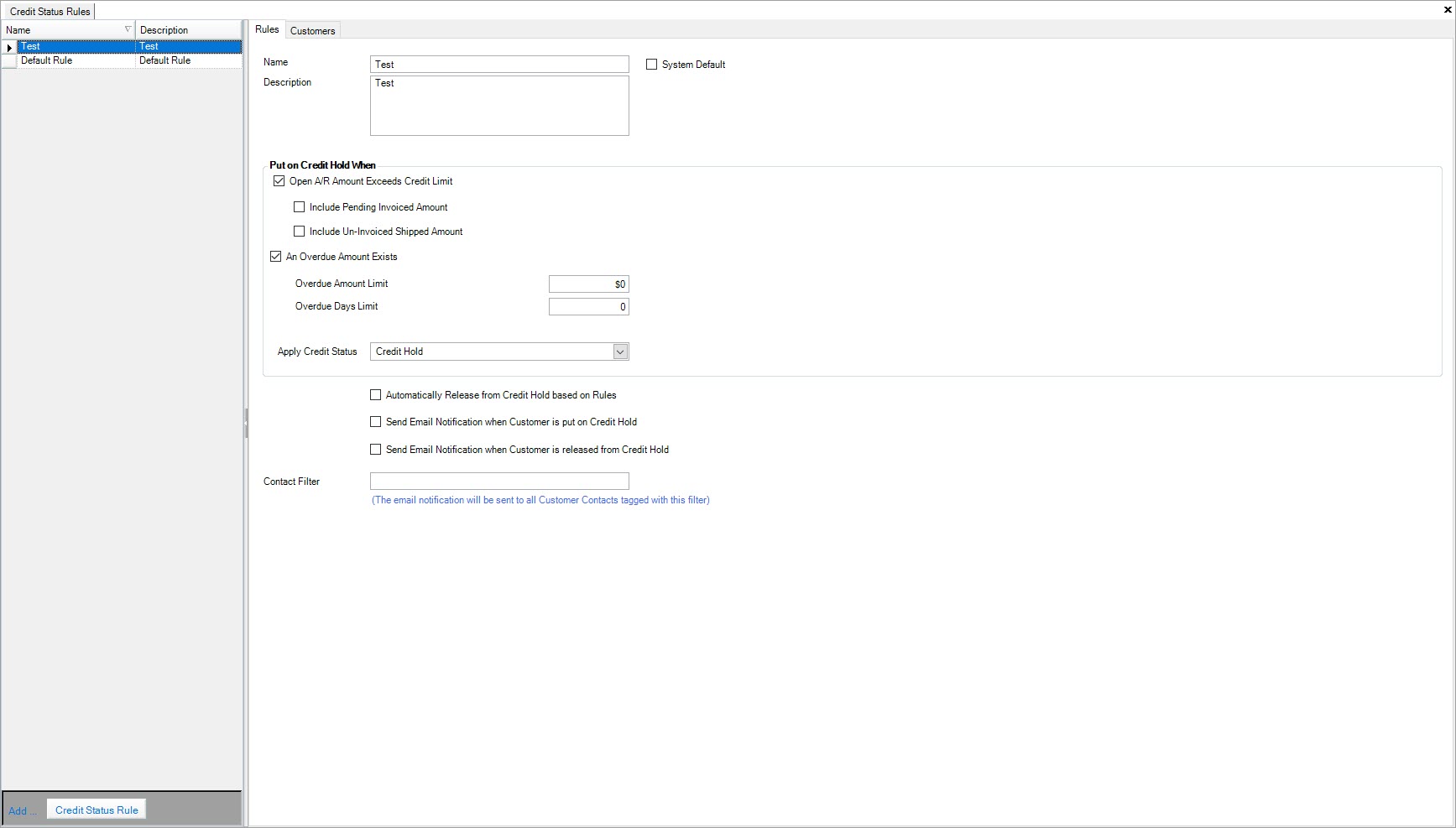

Editing a Credit Status Rule¶

To edit a Credit Status Rule, navigate to the  tab and click on the

tab and click on the  icon. The

Credit Status Rules screen will appear.

icon. The

Credit Status Rules screen will appear.

Locate the Credit Status Rule you wish to edit and highlight the appropriate row. Make the necessary changes under the  tab and/or the

tab and/or the

tab.

tab.

Make sure to save your changes before exiting the screen.

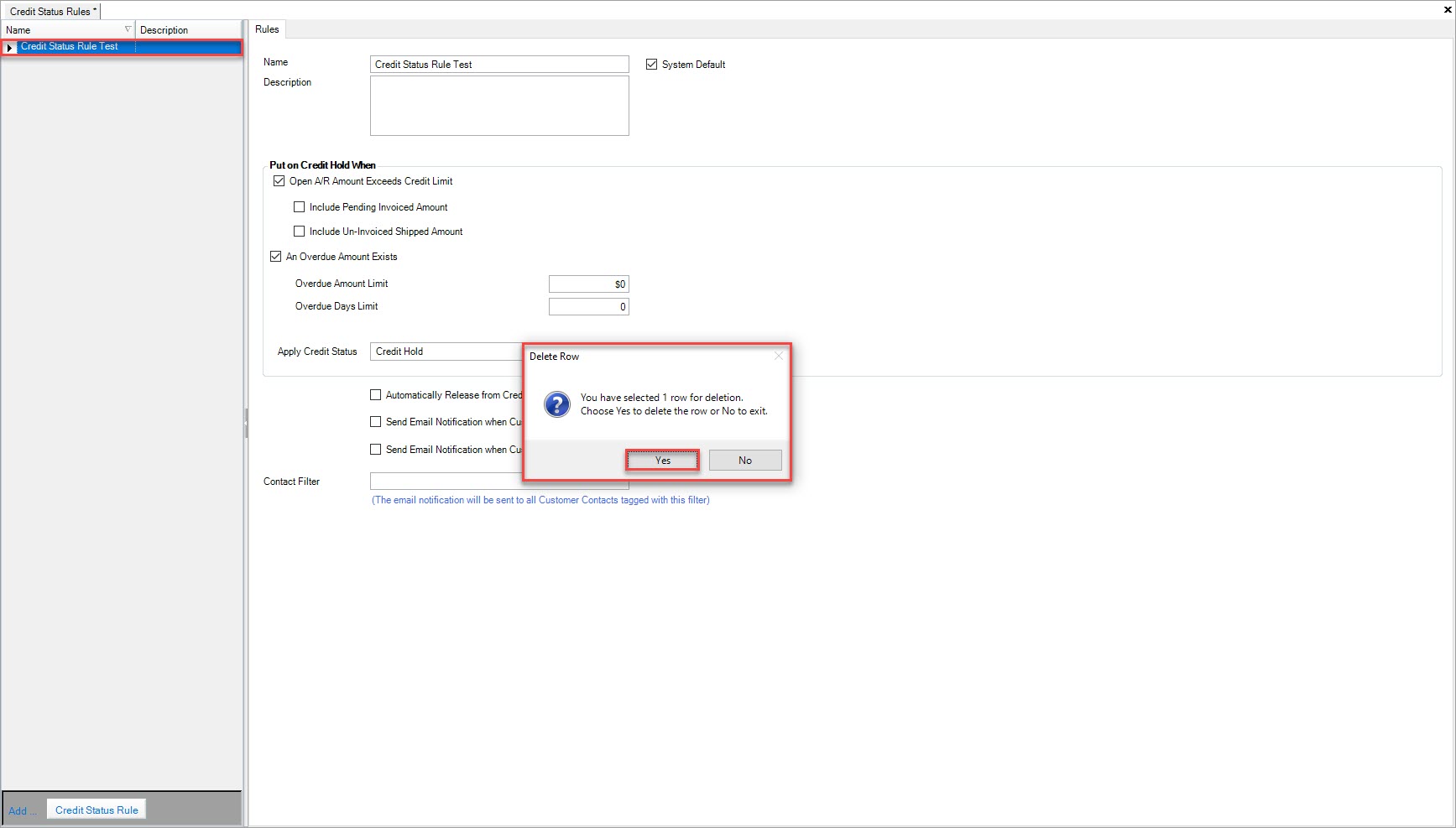

Deleting a Credit Status Rule¶

To delete a Credit Status Rule, navigate to the  tab and click on the

tab and click on the  icon. The

Credit Status Rules screen will appear.

icon. The

Credit Status Rules screen will appear.

Locate and highlight the row of the Credit Status Rule you wish to delete. Use your Delete key and when the system prompts you, select Yes.

The selected Credit Status Rule will be deleted.